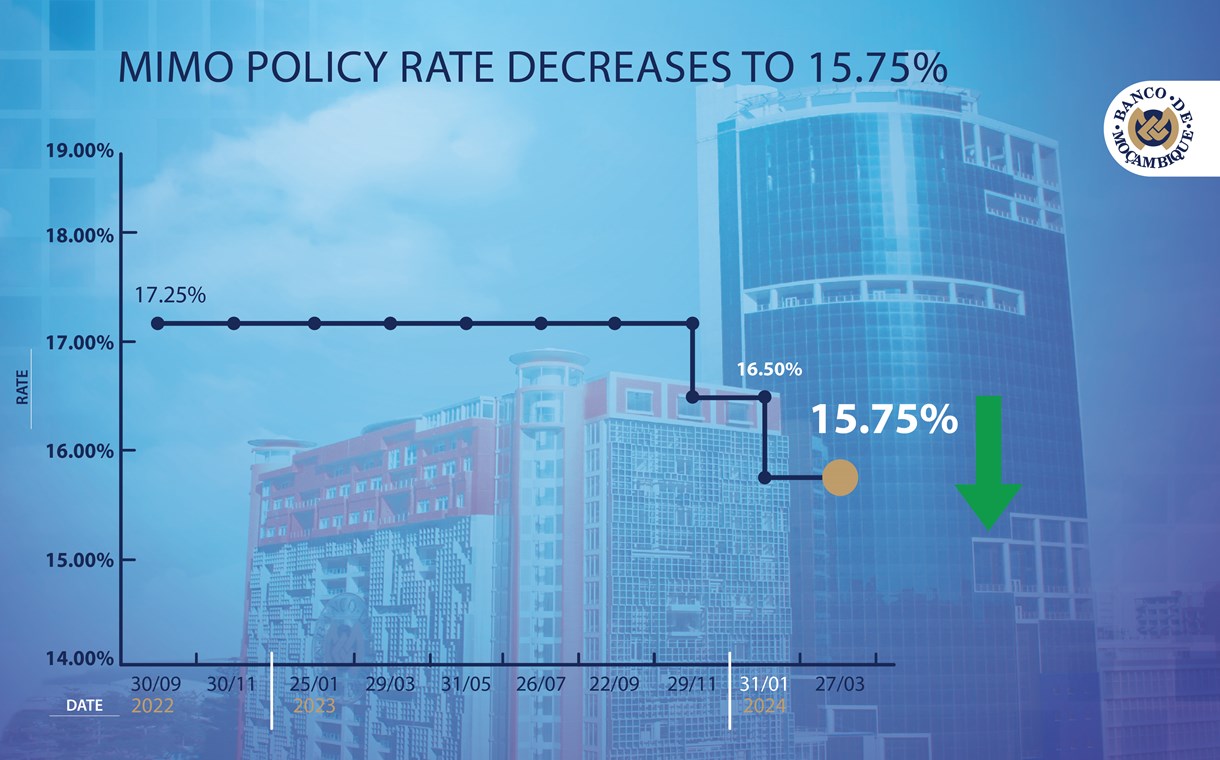

Maputo March 27: Bank of Mozambique reduces the monetary interest rate from 16.50 to 15.75 percent.

COMMUNIQUÉ No. 2/2024

COMMUNIQUÉ No. 2/2024MONETARY POLICY COMMITTEE

The Banco de Moçambique Monetary Policy Committee (MPC) decided to reduce the monetary policy rate, MIMO, from 16.50% to 15.75%.

This decision is underpinned by the

consolidation of prospects of single-digit inflation over the medium term, in a context where the assessment of the risks and uncertainties associated with inflation projections remain favorable.

Prospects of single-digit inflation remain unchanged over the medium term.

In February 2024, annual inflation stood at 4.0%, foowing 4.2% in January.

Core inflation, which excludes fruits and vegetables and administered prices also eased.

Prospects for single-digit inflation

remain unchanged in the medium term, mainly reflecting the stabiity of the Metical and the impact of the measures taken by the MPC.

For the medium term, excluding liqufied natural gas (LNG), the prospects are for

moderate economic growth.

In the fourth quarter of 2023, gross domestic product (GDP) excluding LNG is estimated to have grown by 3.6%, following 3.3% in the previous quarter.

Including LNG, GDP growth accelerated to 5.4%. in the medium term, excluding LNG production, economic activity is expected to continue to recover, despite uncertainties associated with the impact of climate shocks on agricultural production and various infrastructure.

Pressure on domestic public debt remains high. Domestic public debt, excluding loan and lease agreements and overdue liabilities, stands at 344.0 billion meticais, a 31.7 biion increase

compared to December 2023.

The assessment of the risks and uncertainties associated with inflation projections remains favorable.

Possibe factors restraining inflation in the medium term incude the fiscal consolidation efforts and a milder impact of geopolitical conflicts on the logistics supply chain and on commodity prices in the global market.

The MPC will continue with the process of normalizing the MIMO rate in the medium term.

The pace and magnitude wil continue to depend on inflation prospects, as well as the assessment of the risks and uncertainties associated with medium term projections.

The next regular MPC meeting is scheduled for May 29, 2024

COMMUNIQUÉ No. 2/2024

Maputo, March 27, 2024

Policy rate reduced to 15.75%

Rogério Lucas Zandamela

Governor

Source Banco de Moçambique.

Comments

Post a Comment

What do you think 🤔?